QUICK SUMMARY

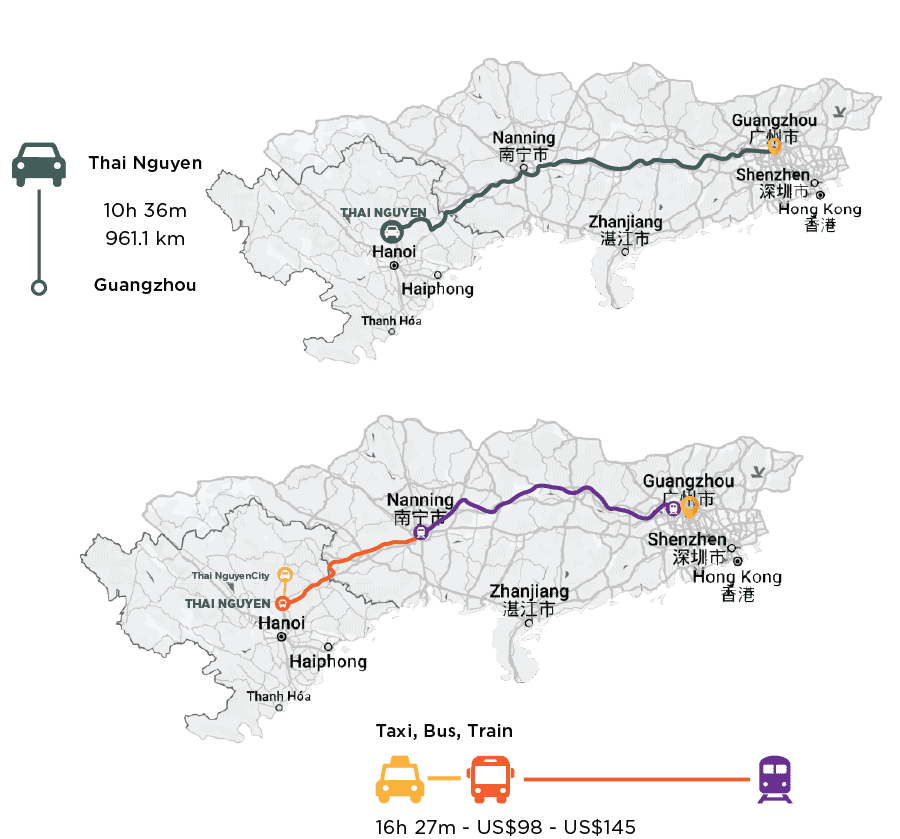

- Location: Xuan Phuong Communue, Phu Binh District, Thai Nguyen Province

- Project Developer: Le Mont Investment JSC

- Site Area: ~ 74 ha

- Land Use Term: until 2071

Thai Nguyen possesses a plentiful workforce, with approximately 760,000 people in the working age group, of which those under 35 years old account for about 58%. The minimum wage in the region is currently low, with Phu Binh district, located in zone 3, at 3,860,000 VND per month.

Thai Nguyen is a major educational hub in the country, with 10 universities, 12 colleges, 8 vocational schools, and over 30 training centers. Each year, the province trains over 100,000 students with qualifications and skills in various fields such as industry, electronics, foreign languages and more. This ensures the best possible supply of labor for investors’ needs.

![]()

Internal Road

41m

![]()

Electricity

22kV

![]()

Water Supply

Cap: 3000 m3/day

Waste – Water Treatment

Cap: 2200m3/day

24/7 Security For

Public Area

Telecom

Modern IT system

Normal tax rate = 17%

(for common industries) is applied for 10 years

In case of an enterprise newly established from an investment project in an industrial park, it shall enjoy exemption from taxation for 2 years and discount of 50% for tax payables in the next 4 years.

Import tax exemption for machinery and equipment which are used to create fixed assets.

Import tax exemption for raw materials and imported materials which are used to produce export goods.

Tax VAT applies to industries from: 0%, 5% and 10%.

VAT exemption for goods including imported raw materials in order to produce export goods under contracts signed with foreign countries.

Enterprises do not have to pay oversea remittance tax.

Electronic component, electrical equipment, power tools, conductors, wiring equipment, solar panels manufacturing industry

Manufacturing, processing, woodworking, wood pulp, shavings, wood pellets, burning pellets, rattan, bamboo and interior decoration items

Mechanical industry, manufacture of machinery, spare parts, equipment, metal products, metal processing, processing and coating

Logistics, Warehouse and Factory Operation

Pharmaceutical, medical instruments, health care products industry

DO YOU HAVE ANY QUESTIONS?

FEEL FREE TO CONTACT US!