The Le Mont Xuan Phuong Industrial Cluster is developed by the Le Mont Group, led by the internal management board with many years of experience in industrial development in Vietnam.

Learn more about Le Mont here

- 70km (55mins) to Hanoi City

- 50km (40 mins) to Noi Bai International Airport

- 40km (50 mins) to Bac Giang

- 60km (50 mins) to Inland container depot

- 150km (1,5 hours) to Vietnam-China border (Huu Nghi boundary gate)

- 176 km (1h 45 mins) to Hai Phong seaport

- Power supply: 22KV

- Water capacity: 3000 m³ /day

- Sewage treatment capacity: 2,200 m³/day

- Wide cross: 41m

Total land area is 75ha & approximately 50ha leasable land.

All industries approved by local authority, except for polluted industry that high risk to the environment and surrounding community

We have reserved 10ha of land to develop RBF, warehouse and other supportive facilities on 2nd stage

Initial launching price at 80 – 99 USD/ m²

Minimum 7000 sqm

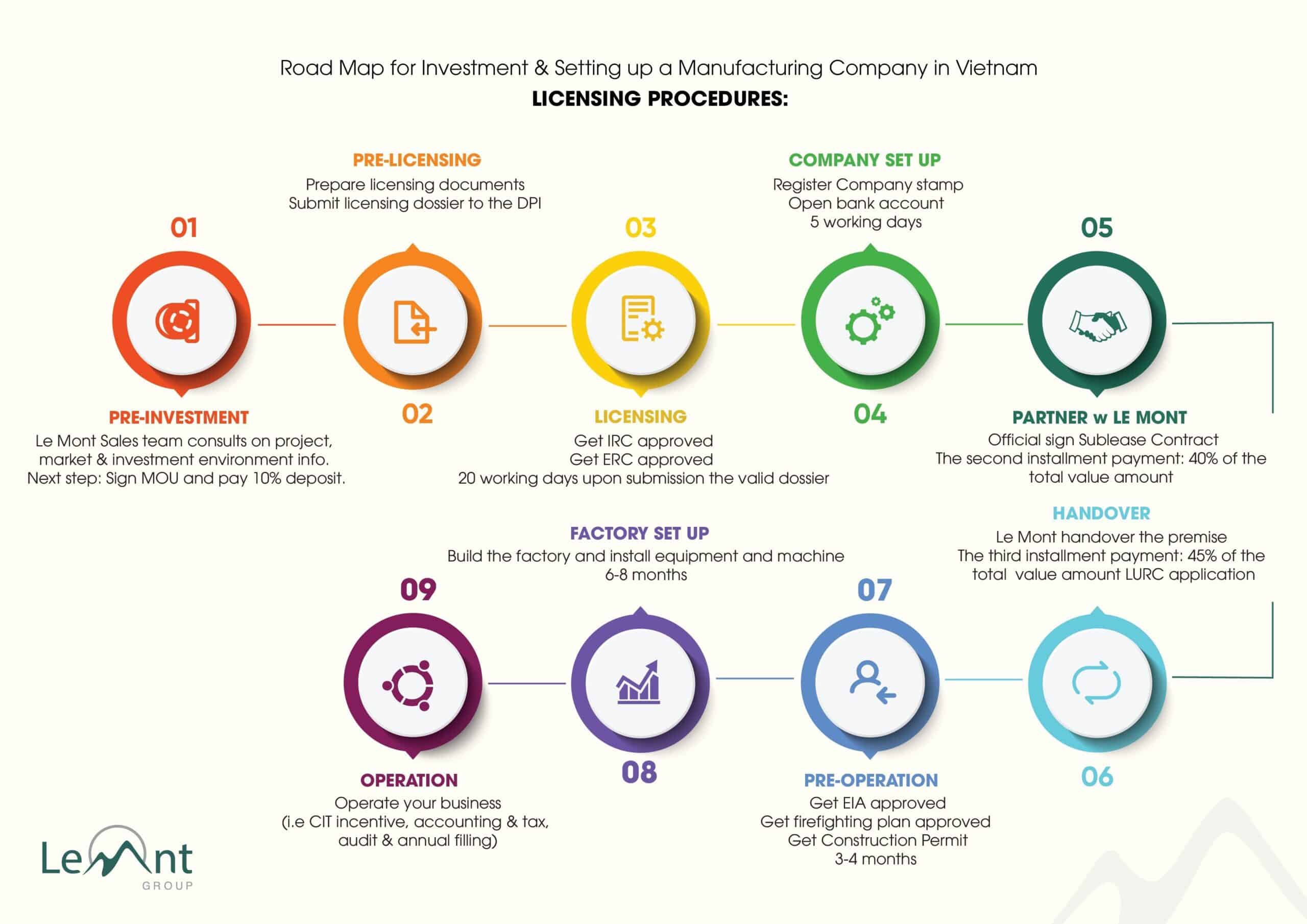

10% deposit (after signing MOI/MOU) + 40% (after signing LA) + 45% (after land handover) + 5% (after LURC)

Tiếng Việt

Tiếng Việt 中文 (中国)

中文 (中国) 한국어

한국어